Introduction

If you are running an e-commerce business or selling anything online, you need a payment gateway to facilitate and collect payments.

In this blog, we will explore what Payment Gateway is, who should use t,hem and the best ones available globally and in India.

So let’s get started!

What are Payment Gateways?

A Payment Gateway is a technology that enables online merchants to authorize and securely process electronic payments. It acts as a bridge between the customer, the merchant’s website & the financial institution that processes the payment.

When a customer makes an online purchase, the payment gateway encrypts and securely transmits the payment information to the payment processor for further validation & processing. Once it is approved, the payment gateway sends the transaction back to the merchant, completing the transaction.

What are the best payment gateways?

On a global scale, many payment gateways have gained widespread recognition and adoption amongst businesses of all sizes as they provide multi-currency support, user-friendly interface, extensive security measures & more.

The ability to seamlessly handle a wide array of payment methods including debit, credit card digital wallets, and bank transfers makes the payment gateways indispensable for businesses with international clients.

Moreover, by prioritizing security & ensuring sensitive customer data is protected, payment gateways have bolstered trust & confidence.

Let’s take a look at the most popular & widely used payment gateways:

1. PayPal: One of the most recognizable names in the world on payment gateway is PayPal, which offers widespread global acceptance, usage, a user-friendly interface & a wide range of integration options for different types of businesses. PayPal supports transactions in over 25 currencies allowing businesses to sell their products & services.

PayPal automatically handles currency conversion, simplifying the process of dealing with international customers.

PayPal also offers “Buyer & Seller” protection policy, seamless integration options, express checkout, mobile optimization, security & faster withdrawals.

Paypal’s reputation as a user-friendly & reliable payment gateway along with its global reach, multi currency support & robust security measures makes it a top choice for businesses of all sizes.

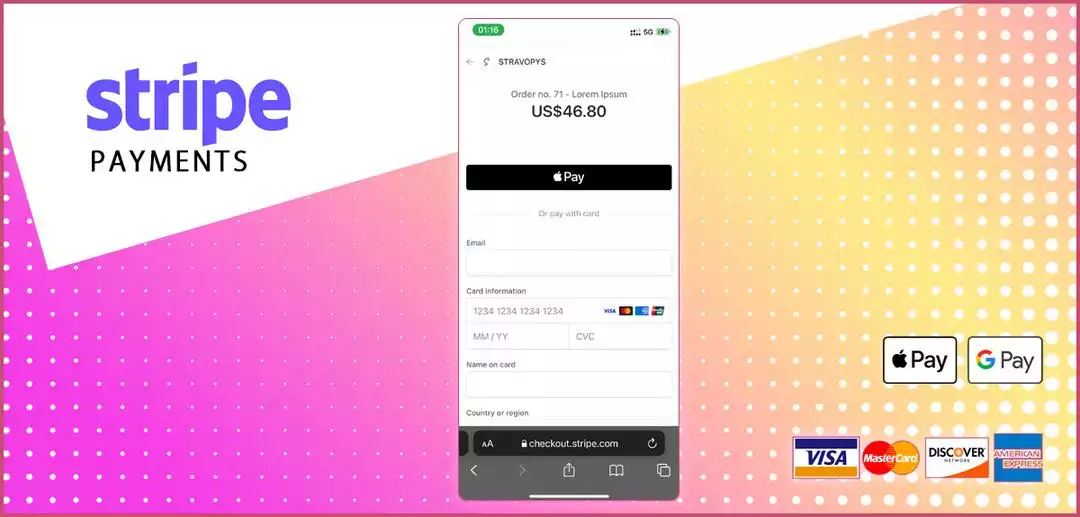

2. Stripe: Number 2 on our list is Stripe. Founded in 2010 by 2 Irish entrepreneurs, Stripe provides a powerful platform that enables businesses of all sizes to manage & accept online payments.

Stripe supports transactions in over 135 currencies making it a top choice for businesses with a global reach.

One of the hallmark feature of Stripe is its Application Programming Interface or API feature known for its flexibility in allowing developers to seamlessly integrate payment processing into websites & mobile apps.

Stripe prioritizes security as per industry standards, including the payment card industry data security standard (PCI DSS).

Stripe also provides Recurring payments, seamless checkout, fraud prevention & transparent pricing.

3. Authorise.net: A subsidiary of Visa Inc., Authorize.net is a leading payment gateway that offers a secure platform to accept a variety of payment methods including credit & debit cards, digital wallets & e-checks. Authorize.net was acquired by Visa back in 2010 as part of Visa’s strategy to enhance its electronic payment services.

Over the years, Authorize.net has built a reputation for its ease of use, integration, reliability & security making it a top choice for businesses of all sizes.

Let’s take a look at some Payment Gateways that are based in India and cater to its large & growing population

4. Razorpay: Headquartered in Bengaluru, Razorpay is a payment gateway & financial technology platform.

We use Razorpay for our online courses and have found it to be extremely useful and easy to setup.

Key features of Razorpay include:

- easy integration

- multiple payment options

- developer friendly

- international transactions

- smart route

- subscription management

- security

- reports & analytics

5. Paytm: Established in 2010 by Vijay Sharma, Paytm is a dominant force in the financial services ecosystem. Paytm’s journey began as a mobile recharge & bill payment platform and now it has transformed into a comprehensive financial ecosystem, becoming a household name in India.

Paytm empowers merchants by offering a wide range of payment options including debit/credit cards, net banking, UPI, digital wallets & more. Here’s why the Paytm payment gateway stands out:

- Multi-payment support

- User-friendly integration

- International transactions

- Security measures

- Customized payment pages

- Fast/quick settlements

- Subscription & recurring payments

- Fraud prevention

6. Instamojo: Another powerful payment gateway making its mark is Instamojo. It offers a suite of services beyond just payment gateway processing, empowering users to create an online presence, sell digital products & manage their financial services efficiently.

Here are some of the powerful features of Instamojo:

- Quick setup

- Multiple payment options

- Link-based payments

- Digital products marketplace

- Online storefront

- Bulk payments

- Customization

- Security

- Analytics

Instamojo provides Free Sign up for Freelancers & businesses of all sizes

What are the types of Payment Gateways?

Depending on the type of your business, your preferences & your budget, there are a variety of payment gateways available. The most common ones are:

1. Hosted Payment Gateways: Hosted gateways redirect customers to a separate and secure payment page which is hosted by the payment provider. Once the customer pays and the transaction is complete, they are redirected back to the merchant’s website

2. Self-Hosted Payment Gateways: This gateway allows merchants to host the payment page on their own website, giving them more control over the payment process. This however requires more technical expertise to setup from the merchant side

3. API Payment Gateways: This type allows more customization options & allows merchants to integrate the payment process directly into their website. This option is suitable for businesses or organizations looking for a seamless & branded checkout experience

4. Bank Aggregators: This option provides a single interface to access multiple banks’ payment gateways. This can be useful for businesses looking to offer various payment options without dealing directly with banks

What’s the criteria for selecting a payment gateway?

When you are considering a payment gateway and evaluating the options, there are several key factors that come into play that you should pay attention to. Some of these are:

- Currency Support: A top-tier gateway should support a wide range of currencies, enabling businesses to cater to customers of different countries & regions

- User Experience: Your user must remain your top priority and therefore an intuitive user-interface and a smooth checkout process are crucial to enhance customer satisfaction, reduce cart abandonment and increase repeat customers

- Security: Protecting sensitive payment data is imperative and hence robust security measures, including advanced encryption protocols & fraud prevention mechanisms play a key role

- Integration: It is important to have compatibility with e-commerce platforms, websites, and mobile apps to simplify the integration process

- Global Reach: If you are running a global business then its important for the payment gateway has accessibility across different countries to support international transactions

- Currency Conversions: Its important to ensure that the payment gateway has transparent & competitive currency conversion rates to ensure cost-effectiveness of international transactions

Which businesses need payment gateway?

Payment Gateways cater to a wide range of businesses and individuals in today’s digital world. Basically whoever is engaged in online monetary transactions stand to benefit and should use payment gateway. Some of the best use cases are:

1. Ecommerce Business: Online stores rely heavily on payment gateways to facilitate smooth transaction of products & services. Businesses like Amazon, Flikart & others entire business models are built on online payments

2. Freelancers: With the rise of online jobs, Freelancers can earn money from offering online services to anyone around the world

3. Subscription based models: Organizations which sell online products & services with subscription-based models can automate recurring payment collection using these gateways

4. Event Organizers: Businesses organizing events, workshops, or conferences can use payment gateways to sell online tickets

Learn all about Inbound Marketing & Hubspot with our blogs

Summary

Selecting the right payment gateway can significantly impact the success of your business.

Whether you are a big organization looking to venture into the world of online, a burgeoning startup, a freelancer, an event organizer or a non-profit organization, payment gateways offer diverse range of features to cater to your individual needs.

As technology continues to evolve, these payment gateways pave the way for a secure, reliable & efficient online transactions driving your business ahead.

Subscribe to our Newsletter to stay updated on all news related to this topic. If you have any questions, email us on mail@digital-doorway.com

Frequently Asked Questions

A Payment Gateway is a technology that facilitates online transactions between a customer's browser and the merchant's website in a secure manner.

It ensures payment information such as credit card details are encrypted and processed securely.

Payment Gateways usually process various payment methods, such as:

- Debit cards

- Credit cards

- Digital wallets (Apple Pay, Google Pay)

- Bank transfers

- Unified Payments Interface (UPI) & more

Yes, many payment gateways support international transactions & can process payments in multiple currencies.

This is essential as many organizations serve global customers these days

It really depends on the payment gateway & the merchant's agreement.

Typically funds are transferred within few days

Need Help?

Interested in scaling your business or get started in Digital Marketing?